2025 Public Budget Presentation

Following the Budget presentation, Council approved the 2025 operating budget which has a proposed increase of 7.5% to the total taxation collected. This will result in a municipal tax increase of 6.8% to the average taxpayer after assessment growth is taken into consideration.

- $88.97 for the average house ($24.92 per $100,000)

- $127.20 per $100,000 of commercial assessment

• Note this is just the municipal portion. The City receives the tax rates from the other taxing authorities in April, which include Cariboo Regional District – 18%, Cariboo-Chilcotin Regional Hospital District – 9%, Provincial Government – 28% and Municipal Finance Corporation - < 1%.

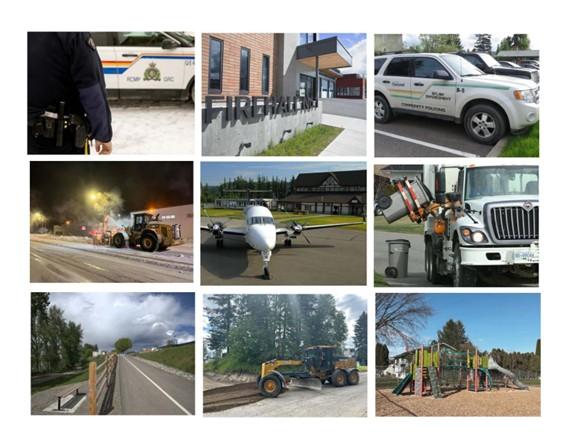

Your taxes pay for services & infrastructure

Delegation - 2025 Active Transportation Plan update

Glenn Stanker, P.Eng., PTOE, Sr. Transportation Engineer, McElhanney Ltd. provided Council an overview of the updated Active Transportation Plan.

The plan sets out recommendations to improve connectivity throughout the city, specifically West Quesnel, Downtown, Johnston Subdivision and South Quesnel.

Development Services

Council approved:

- An extension to the remedial action order on 340 Dawson Street, allowing the property owner until June 30, 2025 to apply for a building permit to repair or demolish the principal building.

- DP2025-80 for enclosing the existing carport at 1382 Paley Avenue, subject to the applicant adhering to the recommendations of the Structural Engineer.

Callanan Street Vacant Land

Council directed staff to forward a letter to School District #28 Board of Education Chair to hasten the transfer of the former Quesnel Junior School lands to the Ministry of Land, Water and Resource Stewardship, for potential development.

Correspondence

At Nazko's request, Council directed staff to proceed with coordinating a meeting with Nazko First Nation.

No comments:

Post a Comment